Navigating Financial Standards

GAAP Principles & IFRS Rules

Explore GAAP Principles for rule adherence and IFRS Rules for global standards, merging precision and complexity in financial governance.

10 GAAP Principles

Principle of Regularity

GAAP-compliant accountants strictly adhere to established rules and regulations

Principle of Consistency

Consistent standards are applied throughout the financial reporting process

Principle of Sincerity

GAAP-compliant accountants are committed to accuracy and impartiality.

Principle of Permanence

Consistent procedures are used in the preparation of all financial reports.

Principle of Utmost Good Faith

All involved parties are assumed to be acting honestly.

Principle of Prudence

Speculation does not influence the reporting of financial data.

Principle of Continuity

Asset valuations assume the organization’s operations will continue.

Principle of Periodicity

Reporting of revenues is divided by standard accounting periods, such as fiscal quarters or fiscal years.

Principle of Materiality

Financial reports fully disclose the organization’s monetary situation.

IFRS Rules

- First-time Adoption of International Financial Reporting Standards

- Share-based Payment

- Business Combinations

- Insurance Contracts

- Non-current Assets Held for Sale and Discontinued Operations

- Exploration for and Evaluation of Mineral Resources

- Financial Instruments: Disclosures

- Operating Segments

- Financial Instruments

- Consolidated Financial Statements

- Joint Arrangements

- Disclosure of Interests in Other Entities

- Fair Value Measurement

- Regulatory Deferral Accounts

- Revenue from Contracts with Customers

- Leases

- Insurance Contracts

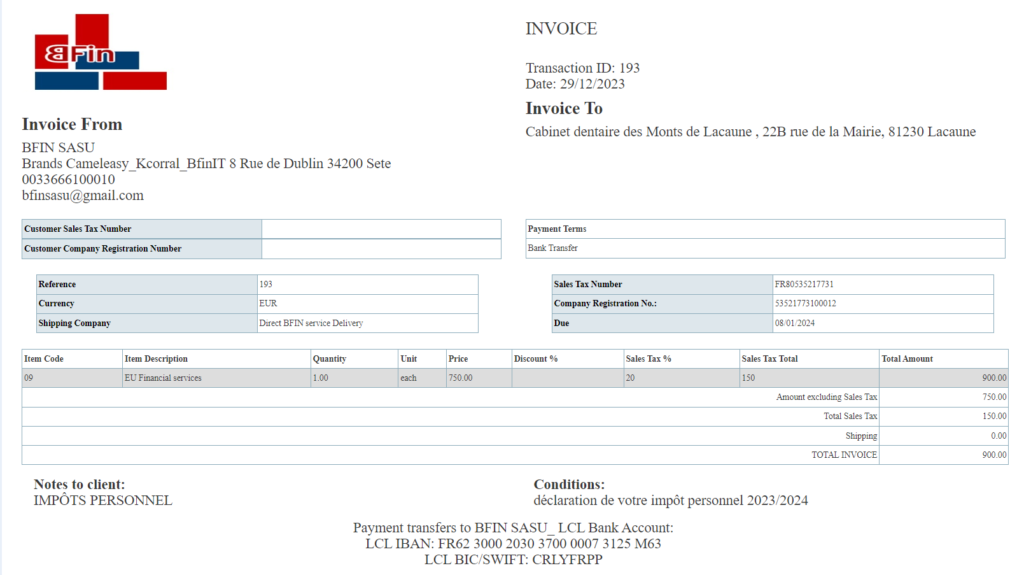

Invoice Sample Image

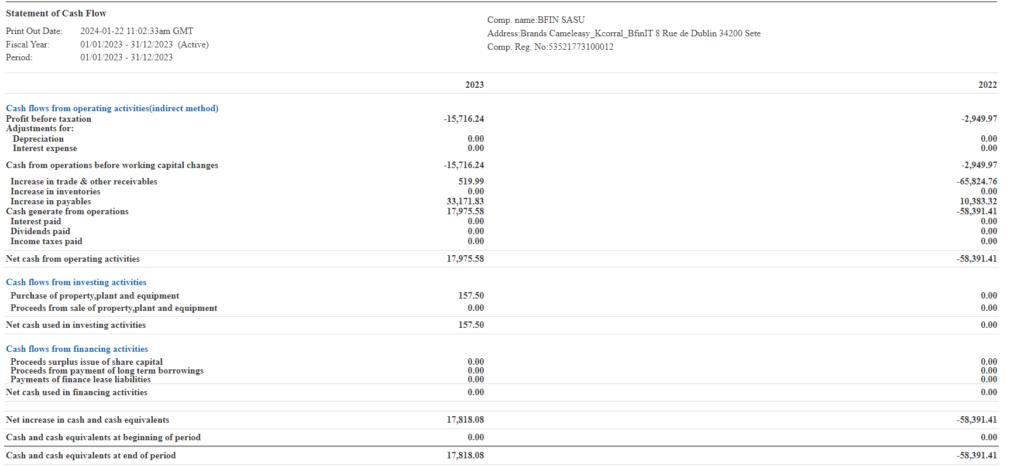

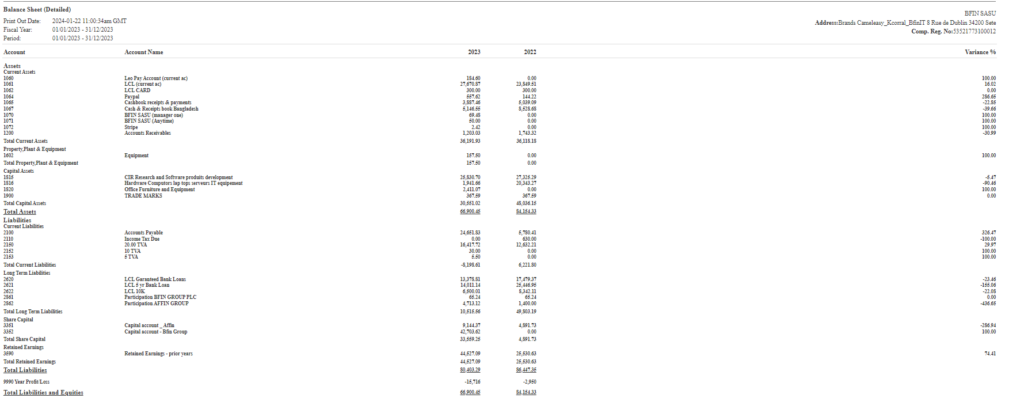

IFRS Report Sample Image